Turn Loan Confusion into Clear Options

See if you qualify for lower payments, forgiveness or cancellation - free analysis, no credit card required

- Comprehensive Loan Analysis for Maximum Savings

- No Need to Decode Complex Loan Rules

- Expert Support Every Step of the Way

Simplify the Complexity of Student Loan Relief

THE PROBLEM

Student loan rules change constantly. Missing the right program could cost you thousands. With so many options and new rules every month, it’s nearly impossible to know if you’re on the best path — or if you’re wasting money.

THE SOLUTION

Student Debt Solutions takes the guesswork out. In minutes, you’ll see every repayment option you qualify for — and we’ll highlight the one that saves you the most money and keeps you on track for forgiveness. Free, fast, and tailored to your situation.

THE TOOLS

Whether you need quick guidance or full support, we’ve got you covered. With 12+ years of expertise, our tools and counselors help you avoid mistakes, stay forgiveness-eligible, and create a repayment plan that fits your life. Choose Basic, Standard, or Premium

See your Student Loan Savings Now

Our online tool analyzes your data against the available programs and recommends the BEST solution based on your goals for FREE. There is no cost to see how much you will save or what program is the right fit.

Since student loan repayments restarted in October 2023, we have helped thousands find a solution to eliminate all or some of their debt burden.

Discover My Savings in 30 Seconds - Free$

331

Avg. Monthly Payment Savings Found

$

43

K

Avg. Total Repayment Savings Found

50

%

Users Discovered Forgiveness

24

%

Users Discovered Cancellation

How Student Debt Solutions Works

1

Create a FREE Online Account

2

Enter Your Financial Data and Goals

3

Upload Your Student Loan File

4

Complete the Questionnaire

5

See Your Personalized Student Loan Analysis

6

Choose Your Solution

7

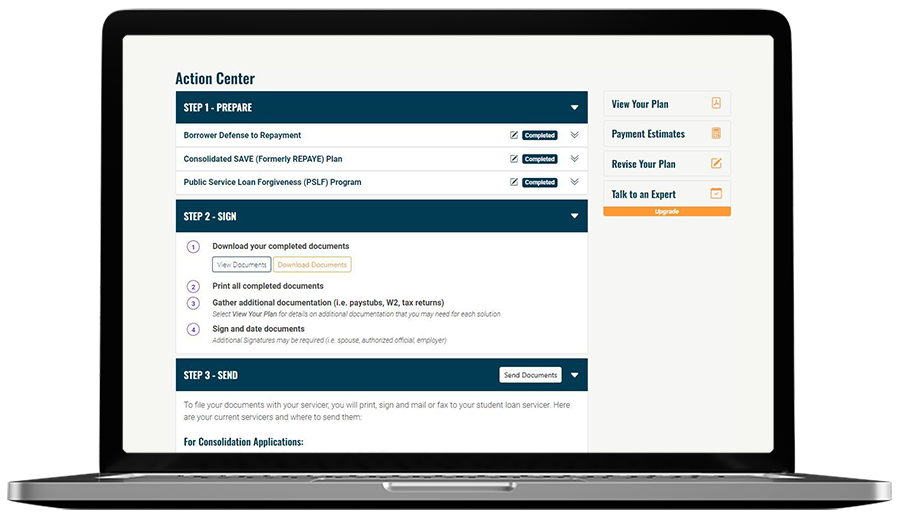

Take Action

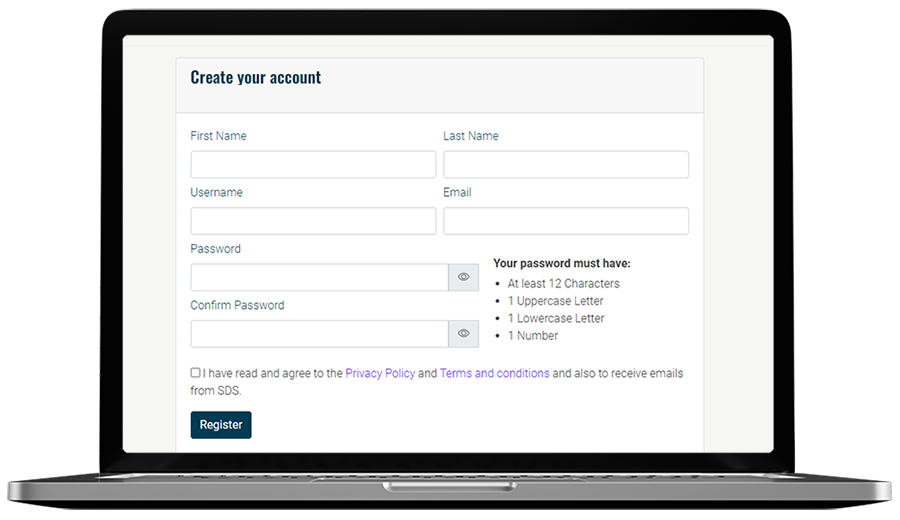

1

Create a FREE Online Account

Start by giving us some basic information and confirm your email account - no credit card required.

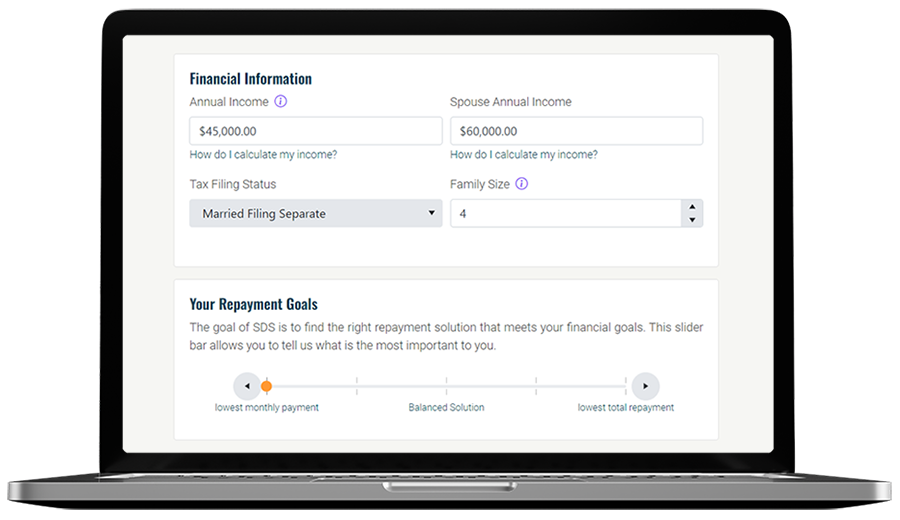

2

Enter Your Financial Data and Goals

Share your income, tax filing status and family size. We’ll ask about your repayment goals and take that into account when recommending the right path.

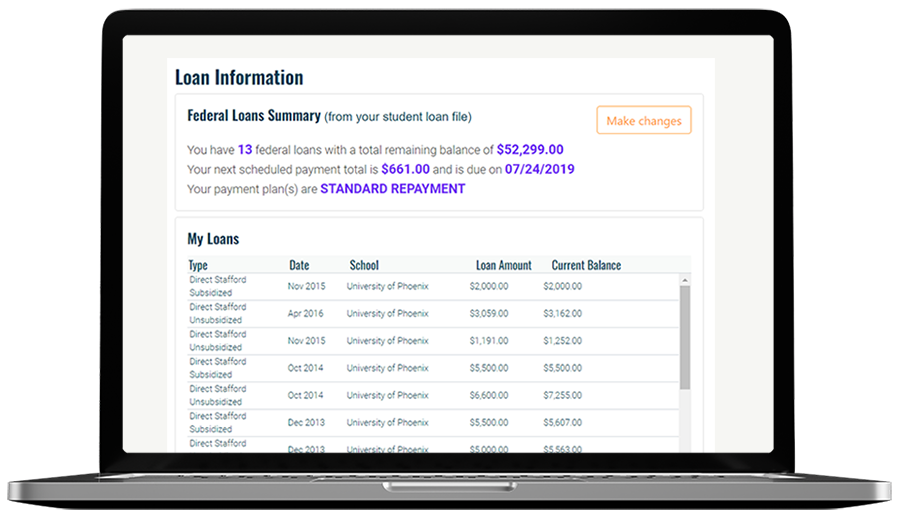

3

Upload Your Student Loan File

All your federal loan data is organized in one file (NSLDS) providing important information for each loan. If you don’t have this file, we can help you get it with your FSA ID and password. Private loans can be entered manually or pulled from your credit report.

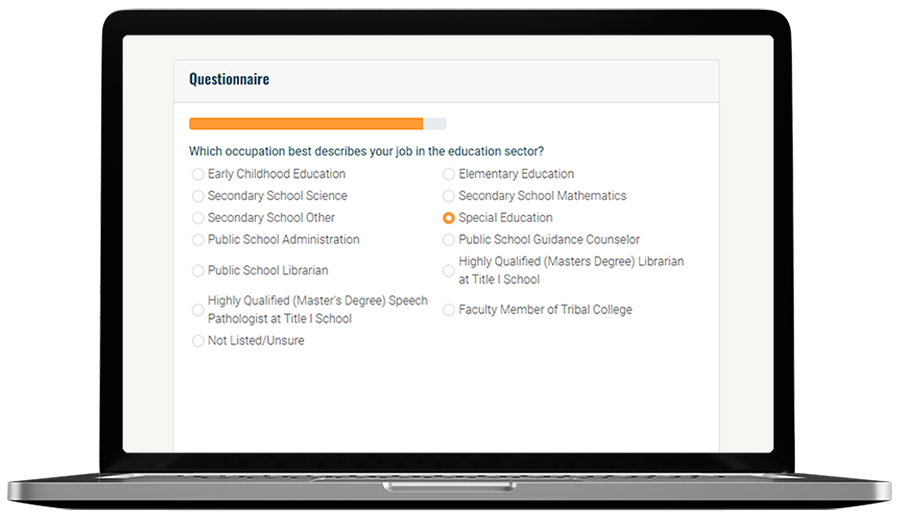

4

Complete the Questionnaire

Using the data you provided, our AI prompts questions specifically designed to quickly and comprehensively grasp your financial situation.

5

See Your Personalized Student Loan Analysis

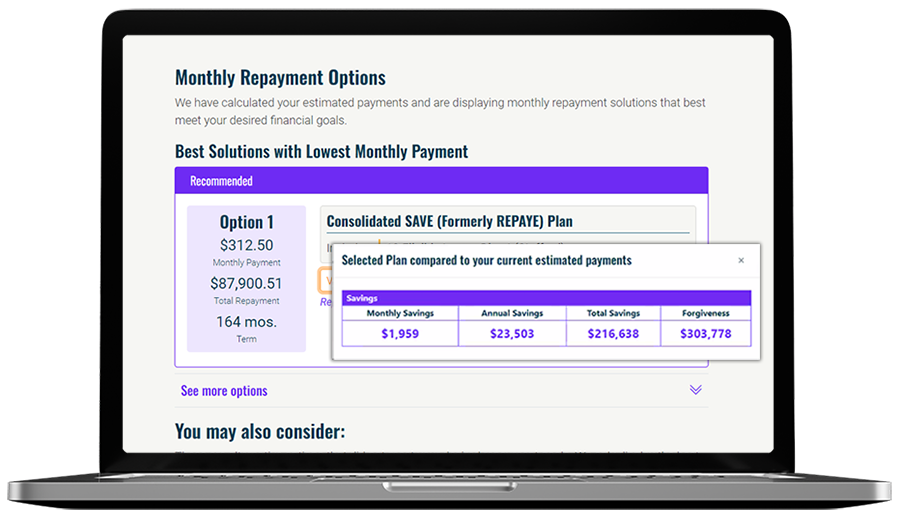

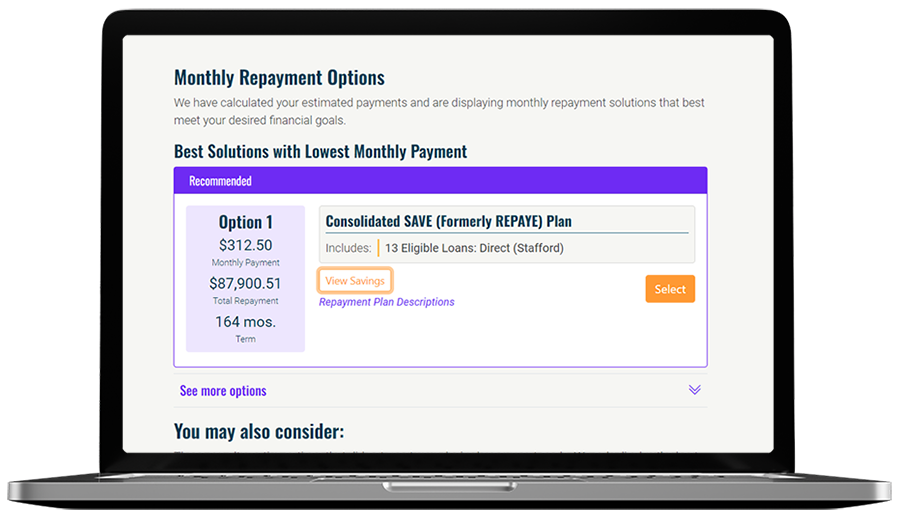

Get a complete list of all your eligible plans and the one we recommend, based on your answers during the questionnaire. Tools to compare your current plan to the recommended plan allows you to see if this is a plan that makes sense for you.

6

Choose Your Solution

Review your options and select the best plan that fits your desired financial goals. Recommended plans include plan highlights, Federal Loans, Private Loans, and tools to help you understand the details – all with no cost!

Helping Our Customers Succeed

"I tried finding help for my loans on my own. After countless hours researching and talking on the phone with people who couldn’t give me answers, I reached out to Student Debt Solutions. Wow! What a difference! I went from frustration to joy."

- Teacher Loan Forgiveness

- Consolidation to qualify for Public Service Loan Forgiveness (PSLF)

- Income Driven Repayment Plan to lower payment

M.D. Orlando, FL

"Working with Student Debt Solutions was like a breath of fresh air. We were able to find a plan that canceled my student loan debt. Before this, I didn’t know this was an option. I can’t say thank you enough!"

- Total and Permanent Disability Discharge resulting in over $50,000 cancelled

B.D. Baton Rouge, LA

"After losing my job and having to relocate, I didn’t think there was any way I could repay the $70,000 I owed in student loan debt. After enrolling, I followed the action plan that allowed me to make very small payments while I work to get back on my feet."

- Income Repayment Plan, lowered monthly payment $700 to $0

- Utilized Calculator to understand annual payments until forgiveness

J.K. Winter Park, FL

"I was in default and couldn’t afford what the collection agency was forcing me to pay. Student Debt Solutions helped me understand the programs available to me. They also helped me build a plan for when I was out of default that fit my budget and financial needs."

- Rehabilitation Program to get out of default

- Income Driven Repayment (IDR)

- Utilized payment estimator tool to understand IDR and forgiveness of debt

K.D. Baton Rouge, LA

Student Loan Expertise You Can Trust

I’m Melissa Maguire, co-founder of Student Debt Solutions and a nationally recognized student loan expert. For more than a decade, I’ve counseled thousands of borrowers one-on-one, trained bankruptcy attorneys and financial counselors, and built the very tools inside SDS to simplify one of the most confusing financial systems in America.

I’m Melissa Maguire, co-founder of Student Debt Solutions and a nationally recognized student loan expert. For more than a decade, I’ve counseled thousands of borrowers one-on-one, trained bankruptcy attorneys and financial counselors, and built the very tools inside SDS to simplify one of the most confusing financial systems in America.

With the help of an amazing team, we created SDS because we saw how easily borrowers were missing out on forgiveness, getting stuck in the wrong repayment plans, or falling into default simply because they didn’t know the rules. Our platform combines the precision of smart technology with the insight of real experts — giving you clear answers, personalized guidance, and the peace of mind that you’re making the right choices.

When you use SDS, you get more than just a calculator:

- Proven Expertise — Over 12 years of hands- on experience helping borrowers maximize forgiveness, lower payments, and resolve default.

- Actionable Guidance — Every recommendation comes with simple next steps designed to protect your finances and keep you on track.

- Human Support — A dedicated team of professionals, available by phone, chat, and text, to answer your questions and walk you through the process.

Student Debt Solutions isn’t just software. It’s expertise, technology, and people working together to give you a clear path forward — backed by the same knowledge trusted by attorneys, nonprofits, and financial professionals across the country.

We Provide:

360° Analysis of your Student Debt

We offer you a FREE, comprehensive analysis of all available solutions for your loans.

Unbiased Third-Party Advice

We are your advocate, evaluating all available programs based on your financial goals.

Transparency

We offer clear, detailed recommendations to help you understand your options.

Tools & Support

We can help make your plan a reality with access to the forms or even a counselor.

A Decade of Industry Experience

Our team is knowledgeable and dedicated. We closely follow the ever-changing rules.

We Are Not:

Department of Education

We are not a government entity and do not administer or coordinate educational loans.

Financial Institution or Private Lender

We are not a bank or credit union and do not offer financial products or refinancing.

Student Loan Servicer

We do not manage loan accounts or collect payments on your student debt.

Credit Repair Company

We do not manage other aspects of your debt or provide claims to improve your credit.

Debt Collection or Consolidation Agency

We do not engage in debt collection, settlement or originate consolidation loans.

Frequently Asked Questions

Your most recent household tax return(s) and your student loan data. If you have federal loans, you can download this information from National Student Loan Data System. If you have private loans, a recent monthly statement should have everything you need.

If you have everything that you need, an average session from start to finish takes about five minutes. Most questionnaires end up being about 20 questions.

Once you complete the questionnaire, your action plan is immediately downloadable as a PDF file. We will also email you a copy as a backup.

We are 100% confident that we can find some type of solution for your situation. We can address various monthly payments you are eligible for or even find a solution such as cancellation or forgiveness. We are positive that you will walk away feeling more confident about your student loan debt and financial situation.

We purposely limit our questions to what is commonly referred to as low-impact personally-identifiable information (PII) to minimize any risk to you. No birthdays, social security numbers, or mother's maiden names here. On top of that, our application meets top information security standards. It holds to the National Institute of Standards and Technology (NIST) Special Publication (SP) 800.53 and is Open Web Application Security Project (OWASP) compliant.

We know there are a lot of options out there, and not all of them are respectable. We are a group of experienced, passionate people that want to help you tackle your student loan debt. We know it’s complex and have spent years working on a self-service solution that is affordable and accessible. We also know some of those other companies (including studentaid.gov) don’t take into account every option and look at your whole financial picture. SDS is an easy-to-use platform that gives you the confidence you’re making the right decisions.

We are not a bank, debt consolidator, collection agency, loan servicer, private lender or refinance company. We don’t sell your data. We are here to help you identify your options so that you can have a debt-free future.

It is true that you can find information about federal programs and payment plans readily available online or by contacting the Department of Education. The hard part is independently sifting through information for the plan/program or combinations of plan/program(s) that match the correct loan types/income/occupation requirements to find the ones you are eligible for and then following through to completion.

You can also contact your servicer, but keep in mind that the servicer’s primary function is as a servicer/creditor. Typically, servicers provide some scope of assistance related to the available payment plans - an overview of what each plan would cost. The servicer also has no visibility to your NSLDS file so their insight into your loan scenario is limited to the current loan they are managing. They cannot determine loan history or consider any repayment or statuses prior to the loan coming under their oversight. Although servicers should be expected to provide quality guidance, they often fall short. This is proven by numerous lawsuits and the recent reports provided by the Center for Financial Protection Bureau (CFPB).

SDS is the only online platform that will truly give a borrower a complete picture of the repayment of their student loans. SDS provides an analysis of your entire student loan debt. When recommending the right plan, we evaluate both government (public) and private loans.